TechRadar Verdict

Honeyfi seems like the perfect way to budget and manage your finances if you’re in a relationship and a relatively small annual outlay bags the premium edition.

Pros

- +

Cheap and cheerful

- +

Customizable budgeting

- +

Bill tracking

- +

Spending notifications

Cons

- -

Annual fee

Why you can trust TechRadar

Honeyfi is a finance-focused app that's been designed specifically for couples. This neat little chunk of software is actually pretty practical in that respect as it lets couples stay on top of their spending and work out budgeting that meets their needs. The great thing about Honeyfi is that it’s very flexible, so it's able to accommodate couples with all sorts of different financial arrangements. This includes configuring the app to work with joint accounts, single accounts or a combination of the two depending on how couples prefer to run their finances.

- Want to try Honeyfi? Check out the website here

It’s possible to fine-tune how much financial data is shared between partners too, which makes a lot of sense given just how many couples end up arguing over money. Honeyfi is also very useful for tackling debts that need to be paid off or helping you to save for events, such as a wedding, vacations and so on.

Pricing

The pricing for Honeyfi is much like everything about this app in that it’s been kept nice and simple. You can use the app for free for 30 days and from there it’s $60 a year per couple. If you break that down to just $5 a month it starts looking like pretty good value for money, especially if you use it in order to shave some cash off your outgoings.

Features

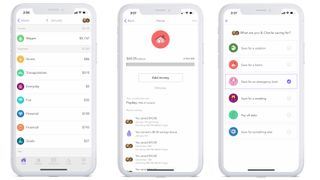

While Honeyfi is pretty lean and mean in terms of usability it’s got a great little set of features. Once you’ve downloaded it and got yourself registered you’ll be able to link all of your accounts and view all transactions. Using that data you’ll also be able to track your spending and keep an eye on budgets, which is perhaps the key objective of using software like Honeyfi.

Usefully, it’s possible to receive notifications when there are new transactions as well as updates on your balances. The added advantage with Honeyfi is that it’s highly customizable, so you can edit categories and also the budgets themselves in order to squeeze the best out of the software.

Honeyfi makes a really practical solution too as it enables saving for goals that much easier, with a number of menu options that let you put money towards a vacation, save cash towards a home purchase or simply pay off outstanding debts.

Performance

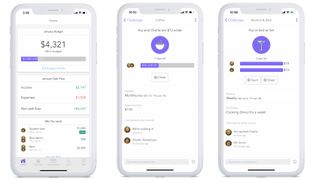

The designers of Honeyfi have done a great job at making it a really practical solution that, well, just works. Keeping tabs of things like money-tracking events is super easy, which makes a lot of sense if you share your spending habits with a partner. If you're looking to reign in spending then your other half can be monitored to ensure they don't go overboard with their budget.

While that might sound a little draconian, using Honeyfi in practice often gets couples talking about money in straightforward terms rather than arguing about it. The way the messaging option works within the app means it’s quick and easy to ask your partner about a specific spend while keeping everything on the level. In terms of performance Honeyfi does a great job of ticking over nicely, both on iOS and Android.

Ease of use

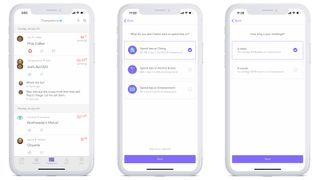

There’s plenty to love about the ease of use that comes with Honeyfi. Simply download the app, register your details and you’ll be able to work through the steps for configuration. Bear in mind that Honeyfi doesn’t come with the option for using it on a desktop machine either, so if you’ve got to carry out any tasks then it’ll need to be done on a mobile device.

Considering that a lot of spending is done on the go, especially when it comes to everyday items that can put a real dent in your budget, this seems like a perfect arrangement.

Once it’s set up the app is also ideal for being able to message your partner if you spot something on the transaction list that you weren’t expecting. Once you’ve got your accounts linked and budgets set the app is a doddle to dip into for everyday use.

Support

The general ease of use that comes with the Honeyfi experience means that you shouldn’t have too much in the way of operational problems. It’s available for both iOS and Android devices, so downloading and installation is relatively straightforward. You might need some help with linking and syncing bank accounts, for example, but Honeyfi has a help hub online that offers up a wealth of different topics.

There’s also a chatbot-style assistant when you sign-up, which lets you contact the team and ask about anything that doesn’t make sense. Generally speaking though we found pretty much anything that we weren’t sure about was covered in the help files database.

Final verdict

Honeyfi seems like a great way of keeping on top of your finances, tracking spending habits and preventing arguments about money if you’re in a relationship. The big advantage with an app like Honeyfi is that it can be tailored to reveal as much or as little about a couples’ finances as you like. Therefore, if you’ve got shared bank accounts then it’s easy to keep tabs on overheads that you both share, and also to tackle key areas of your joint finances, such as savings and debts.

At the same time, Honeyfi can cater for those of us who want to keep some of our money matters separate from the other person in a relationship. Being able to comment on transactions from within the app adds a touch of fun to proceedings, without it being too intrusive. Honeyfi is a brilliant expense tracking package too, allowing users to pinpoint any transaction and tweak financial arrangements accordingly.

- We've also highlighted the best accounting software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.

Scientists inch closer to holy grail of memory breakthrough — producing tech that combines NAND and RAM features could be much cheaper to produce and consume far less power

Google adds biometric verification to Play Store to keep your in-store wallet safe

Quordle today – hints and answers for Wednesday, April 17 (game #814)