TechRadar Verdict

A safe and easy-to-use platform for purchasing, transferring and trading crypto. However, the various fees can rack up quickly.

Pros

- +

Easy to use

- +

Off-chain transfers

- +

Supports multiple fiat currencies

Cons

- -

Tricky fee structure

- -

Tracks crypto usage

Why you can trust TechRadar

Based in the US, Coinbase is one of the biggest fully-regulated cryptocurrency exchanges. Since launching in 2012, Coinbase is said to have facilitated transactions worth more than $455 billion and its 40 million verified users hold over $90 billion worth of assets on the platform.

Coinbase allows you to buy and sell Bitcoin, as well as over two dozen other cryptocurrencies. It also supports several fiat currencies, including the British Pound, US Dollar, the Euro and more.

The company also launched the Global Digital Asset Exchange (GDAX) to better serve users who trade high volumes of crypto. GDAX is now known as Coinbase Pro and offers various trading tools designed for professional traders.

In addition to standard exchange features, Coinbase supports off-chain transfers, which allows users of the platform to send funds between one another without incurring transaction fees.

- Purchase cryptocurrency from Coinbase here

Fees

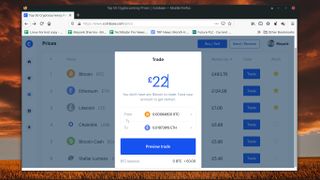

In addition to being an exchange, Coinbase also offers a wallet service to all its users at no charge. But while off-chain transfers between users are free, all transactions that involve cryptocurrency leaving the platform attract a fee - and the company's fee structure is a bit tricky to wrap your head around.

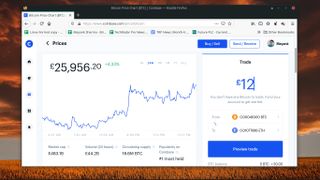

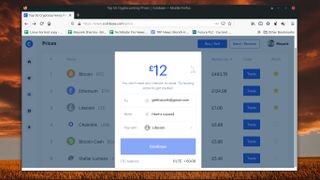

The platform adds a spread of about 0.5% for all crypto purchases and sales to the prevailing exchange rate. In addition to this, it also charges a Coinbase Fee. This fee is the greater of either a flat fee, which is relative to the amount transacted, or the variable percentage fee that’s based on your location and payment type.

For a cryptocurrency conversion, Coinbase charges a spread margin of up to 2%. For maximum transparency though, the platform will disclose all fees at the time of your transaction.

Interface and ease of use

Coinbase supports several payment methods, including wire transfer, debit and credit cards. Note, however, that payment methods vary by country. Make sure you check this ahead of time, because in the countries that only support credit/debit cards, you can only use Coinbase to buy cryptocurrencies, since the platform cannot transfer funds back onto a card. You can still obviously transfer crypto on and off the platform.

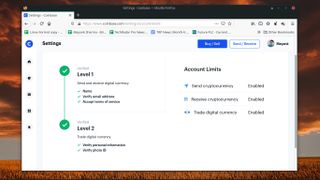

Once you’ve created an account on Coinbase, you’ll have to follow through with the platform’s Know Your Customer (KYC) and anti-money laundering (AML) provisions, which include submitting a Government issued photo identification card. You will only be able to use the platform after the documents have been processed, which usually only takes a couple of minutes.

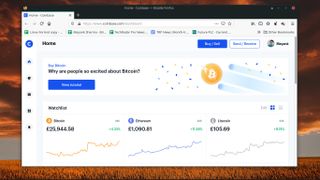

One of the strengths of Coinbase is its intuitive user interface, which can be operated without trouble by inexperienced users as well. The main dashboard displays an editable price chart of cryptocurrencies, along with your portfolio and recent transactions. Use the big Buy/Sell and Send/Receive buttons at the top of the dashboard to purchase and trade crypto.

Security

It's important to remember that Coinbase is a custodial service, which means you don’t hold the cryptocurrency, since the private keys are kept by the platform. You can, however, send any crypto you own to your non-custodial crypto wallet.

In fact, even Coinbase has a mobile wallet of its own for both iOS and Android. However, be aware that you’ll have to pay a miner’s fee for sending money to the Coinbase wallet or to any other wallet outside Coinbase.com.

In terms of security, Coinbase says it keeps almost 98% of its assets in an offline cold storage that can’t be accessed or broken into. Furthermore, the company claims any assets held in the hot wallet system are insured. Coinbase also covers all the cash balances of its US residents under the Federal Deposit Insurance Corporation (FDIC) protections, to the extent of $250,000 per individual.

These protections are the result of Coinbase’ strict compliance with the federal regulations in the US. The downside of this level of oversight, however, is the platform’s notoriety for freezing access to accounts that use their crypto for activities it considers shady, including paying for pornography.

Support

Coinbase has a very extensive knowledge base, with illustrated documentation for all its products and services. The information is neatly catalogued for easy access under various categories.

For instance, first time users should peruse the articles under the "Getting started" section, before moving on to more advanced topics under the "Trading and funding" category. There’s also a search box that will help you dig out relevant information.

You'll probably be able to find an answer to most standard requests in the knowledge base, but if not, you can raise a support ticket. However, keep in mind that Coinbase has a Better Business Bureau rating of D- for its failure to respond to over 400 complaints filed against the platform.

Based on the complaints on the platform (and elsewhere on the internet), Coinbase is notorious for its slow response time to support tickets.

However, the platform does list phone numbers that customers can call to disable their account in the event it is compromised.

Alternatives

One of the biggest factors that works against Coinbase is its complex fee structure. While the problem is a consistent across a number of rival services too, others like Binance are a lot cheaper.

Also, unlike some of its peers, Coinbase strictly adheres to regulations. While on the one hand this makes the platform safer, on the other it also makes it unsuitable for anyone wishing to protect their anonymity. Coinbase is required by law to identify its users, who will be expected to pay taxes on their crypto trades as per local law. This makes the platform a no-go for users who use crypto because it was designed to be a decentralized and anonymous way for conducting transactions.

Another major problem with Coinbase that you won’t have on most other platforms is that it tracks and monitors how users spend their coins and isn’t averse to freezing accounts.

Final verdict

Coinbase is an easy-to-use cryptocurrency exchange that prides itself on its regulatory compliance, which is the source of both its unique strengths and weaknesses. While the platform’s spread for crypto transactions is comparable to its peers, its fees can quickly add up depending on the size of transaction and the mode of payment.

On the plus size, the platform will attract new users who want to dabble with cryptocurrency without hassle. If you do your due diligence, Coinbase can be an affordable medium for buying crypto with your fiat currency. Its low spread will encourage small time traders to get a taste for crypto and the safeguards and insurance mechanisms will give them the peace of mind they need.

- Sign up for a Coinbase account here

With almost two decades of writing and reporting on Linux, Mayank Sharma would like everyone to think he’s TechRadar Pro’s expert on the topic. Of course, he’s just as interested in other computing topics, particularly cybersecurity, cloud, containers, and coding.