How to start crowdfunding

Get the ball rolling

When you’ve decided upon the type of funding you’d like to use, you need to find a funding website or platform that supports it. This can appear daunting, because there’s an ever-expanding number of funding platforms to choose between, such as Kickstarter, Crowdfunder, Indiegogo and Seedrs.

Your initial approach to a platform is then very important. We spoke to Alysia Wanczyk, Seedrs’ marketing director, about what actually happens when an entrepreneur and a funding platform meet each other for the first time. She explained, “Once a business completes their online investment campaign, it comes through to our review team. The team then goes through and initially rejects any campaigns that are patently unviable, incomplete or plain silly. Those that proceed are carefully reviewed to ensure that every statement they make is fair, clear, not-misleading and truthful.”

Unlike eBay, where the process of adding sales posts or landing pages is highly automated, Seedrs’ registration system is much more human. Wanczyk continued: “This [checking process] often requires a bit of a back-andforth email and phone exchange between us and the entrepreneur, to ensure we receive supporting evidence for every statement. Once both parties are happy with the campaign, we set it live to potential investors to review – with the peace of mind that what they’re reading is reliable. From there, it is up to investors to look around, ask questions and decide for themselves if a business is worth investing in.”

- Check out our roundup of the best small business software

- And here's our list of the best small business website builders

- We've also featured the best online marketing services

Pass or Fail?

Funding campaigns usually last for around three months, Wanczyk told us. The question is, of course, what happens if you’re successful? We asked Wanczyk whether the cheque arrives the next day. She explained: “Once a campaign has hit its funding target, we conduct a further due diligence process to ensure that all legal and structural matters are in order with the company. It is all very straightforward.”

What this boils down to is essentials such as registering the company with Companies House, setting up a company bank account, and completing taxation documents. And if you’re not so lucky? Wanczyk told us, “If a start-up doesn’t reach their target [within three months], their campaign is taken down and each of the investors is given their investment back and notified. Sometimes, a business is given feedback from investors and potential investors and they take down the campaign themselves to change it and re-submit it.”

How to invest for profit

Let’s be clear: investing in start-ups is incredibly risky. The Financial Conduct Authority suggests that 50 to 70 percent of new enterprises fail. But with risk, of course, comes reward. And it’s for this reason that crowdfunding is sometimes viewed as a goldmine by canny investors. So, if you’re sitting on some cash, how can you turn a profit? Seedrs’ Alysia Wanczyk explained the rules of investing via her platform: “Adults over the age of 18 who pass our investment authorization questionnaire or self-certify as high net worth or sophisticated can invest.”

Assuming you satisfy the questionnaire’s requirements – a document prepared with the FCA, so not to be taken lightly – you can invest anything from £10 up via Seedrs. Julia Groves of the UK Crowdfunding Association told us about her approach to investing: “My rules are: I have a fixed amount of money I invest each business year – money I can afford to lose.” She also viewed investing in different products, to spread risk, as important. Finally, she told us to invest in things you know about and want to support. “I can and do put as much money as I can into renewable energy, because I have been working in that sector for 10 years and I am an environmentalist.”

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Bill Morrow from Angels Den also explained the importance of investing in firms that have SEIS (Seed Enterprise Investment Scheme) and EIS (Enterprise Investment Scheme) approval. He told us: “Having SEIS or EIS approval makes a business so much more investable, because it offers huge tax benefits for UK investors. Most investors will want SEIS or EIS deals to make up a significant part of their portfolio. It also means that you don’t get taxed when you exit the business.”

Also, consider dilution. In the first round of funding, you may buy 10 percent of a firm. But as they grow, start-ups tend to launch other fundraising drives. If they do, they may issue more shares, meaning you’ll be left holding a reduced proportion of the whole. And with a reduction in holding comes a reduction in dividend income

The anatomy of a landing page

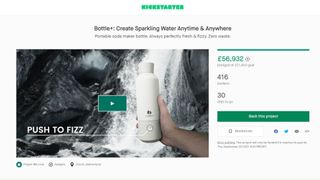

The landing page is a crowdfunding project’s shop window. It’s where an entrepreneur hopes to catch the eye of an investor and quickly persuade them to get their chequebook out. There are lots of different crowdfunding websites, so landing pages will all look subtly different. There are, however, some essential pieces of information that occur across nearly all the different platforms. Here are the key elements that you will need to think about when building your own landing page.

- Project name: Give your project a pithy but immediately obvious name. Don’t try to be too clever or investors might be confused.

- Updates: Crowdfunding is all about building a community. As your funding drive develops, it’s a good idea to post blog-style or video updates about the successes that you’re having

- Comments: It’s important that entrepreneurs talk with their investors, allaying their fears and feeding their interest

- Backers: These are the people who have offered to contribute to your project

- Pledge and goal: Here you’ll see how much money has been promised and the funding target you need to meet. Hit your target and all the funds will be released. Miss your target and you may get nothing

- Time ticker: Most funding drives last for a few months. Your landing page will have a countdown ticker that shows how much time investors have left.

- The entrepreneur: Projects aren’t just about products, they’re about people. You need to be the face of your project and champion it at every possible opportunity.

- The video: There’s no better way than using a video to communicate your pitch and its key points. Project videos are usually three minutes long.

- The promise: A product pitch needs to identify a problem and explain how it will solve that problem. You need to think hard about your project’s pitch and promise.

Eight tips for a successful campaign

Research, research research

You need to understand the market you’re planning to launch into. This means scoping out your competitors and any hurdles that might need to be overcome. In essence, think about doing a SWOT analysis of your idea. Going through this process is essential because you’ll most definitely be quizzed about these sorts of business fundamentals as you progress from the idea stage through to funding. And don’t think investors will go easy on you just because you’ve never been through the process before. Investors will certainly have lost money before and they’ll be mustard keen to avoid doing so again.

Get thinking straight

An idea doesn’t have any value, no matter how good it is. It is the execution of the idea that creates value. So, don’t get hung up on your initial concept. Rather, think and talk about the business that you’re building around the idea. You should also be able to explain your business succinctly, maybe in just one sentence. Be sure you can explain the problem you’re looking to solve and how your business will solve it. If an investor doesn’t understand your business – even if it’s amazing – they’ll pass it by. Your business’s reasons for being – its mission statement - should be echoed consistently across all communication channels at all times.

Planning and Milestones

Taking a project from an idea to a fully-fledged business can seem very daunting. Beyond providing you with both encouragement and direction, having a solid plan also looks good to investors. You might, for example, raise capital so you can achieve phase one, and then return to the funding market and ask for cash to begin phase two. If the first chapter of your business story was a success and your investors are happy, you should find it easier to entice a second wave.

Raise just what you want

Spending other people’s money is fun, but you’ll have to pay it back. So, it pays to work out exactly how much money your business is going to need. This means you will have to pay less back and, also, it will serve to convince prospective investors. Anyone looking to invest their own money in a project is much more likely to trust somebody who can show that they’re serious about cash management. So, get your calculator out, fire up Excel and then work out the exact sum of money your business needs to work, and – at this stage – no more.

Make a video

The most potent way to tell your business’s story to prospective investors is to make a video. You don’t need to make an epic – consider three minutes the maximum length of time you have to convince people. When you’re planning your video, ensure you communicate your business’s key pledges and the problems you’re looking to solve very clearly. It also helps to have a logo at this point, too, because it conveys permanence and solidity. If you’d like more guidance about making your video, head over to Videohive . There you’ll find some excellent resources. (All that thinking and research you did in steps one and two should come in handy!)

Don't go live just yet

Veeqo founder Matt Warren offers a great tip. Before you launch your funding campaign, talk with your friends and family, and persuade them to promise some small contributions. When your campaign does go live, their financial support will give your project an instant lift. This is beneficial because investors don’t generally like to be the first to pledge money. Rather, they prefer to see a project that’s already generating some momentum and is already going somewhere. So, don’t hurry into going live as soon as you can. It pays to get some early, pre-backers primed and ready first.

Embrace social media

When your campaign is up and running, you need to be able to create a real buzz around it. Just sending out a press release is probably not going to be enough. You need to be fanning the flames with social media. There is, of course, a huge number of platforms to choose from. If you have limited resources, you need to focus your attention on the ones that investment professionals are likely to use: LinkedIn and Twitter. Get your team involved, too. The key is to have a constant output of messages. Don’t splurge and then go quiet. And don’t view social media as a one-way street. Talk with people who take the time to message you.

Don't forget offline too

It’s easy to rely purely on digital promotion to promote digital products. There is, however, no substitute for getting out and meeting prospective investors face to face. There are lots of meet-ups where new businesses can network with professional investors. To find out about such gatherings near you, try visiting EventBrite. It’s a site that chronicles a huge number of professional events that happen around the world. In many regards, it’s the ultimate diary. The point is, don’t just sit back and expect investors to find you – there’s a dizzying array of projects vying for their attention.

- We've also featured the best business plan software