UAE telcos report lower second-quarter revenues due to decreased mobile usage

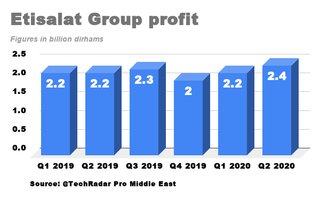

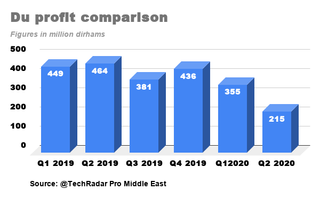

Etisalat’s profit increases 9% to AED2.4b while du witnesses 53% plunge to AED215m

Telecom operators in the UAE – Etisalat and du – reported lower second-quarter revenues as voice and data traffic shifted from businesses to residential lines and from outdoor to indoor usage due to Covid-19.

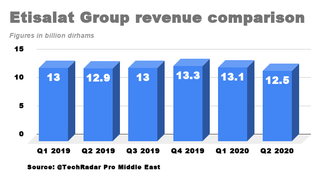

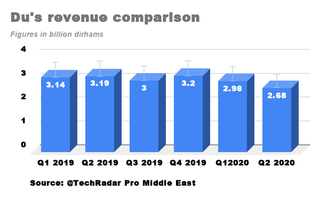

The country’s largest telco Etisalat, which operates in 16 markets across the Middle East, Africa and Asia, suffered a 3.1% decline in second-quarter revenues to AED12.5b compared to AED12.9b a year ago while du’s revenues plunged more than 15% to AED2.68b compared to AED3.19b a year ago.

The second-quarter mobile revenues were under pressure due to the movement restrictions across the country, which led to an erosion of the base as a result of lower gross additions and lagged churn and a shift in customer behaviour from prepaid mobile usage to fixed usage as companies implemented work from home initiatives.

Even though Etisalat reported a profit of 9% to AED2.4b in the second quarter of this year compared to AED2.2b a year ago, du’s profit plunged more than 53% to AED215m compared to AED464m a year ago.

Krishna Chinta, Program Manager for Telecommunications and IoT at International Data Corporation (IDC), said that the pandemic situation has posed new challenges for the telecom operators as the mobile and fixed traffic consumption patterns have altered in unprecedented ways and this will certainly influence telecom operators to bring about certain changes to their operations as well as their cost structures as long as the impact lasts for.

Dividends approved

According to market intelligence firm Omdia, the Middle East and Africa will see a 3.9% decline in mobile service revenues to $84b, representing a downgrade of 8.4% from its previous forecast.

Worldwide, mobile communications services market revenue will fall by 4.1% year on year to $749.7b this year compared to $781.5b, down from the prior forecast of $800.3b.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

An industry expert said that the opening of communications tools such as Zoom and Microsoft Teams to work for the first time in the UAE from residential lines is dealing a blow to its voice and data revenues as people are using it over WiFi.

“The rapid take-up of ToTok from 2019 is shifting a large amount of calls to the application and operators could see a significant drop in voice revenue for the rest of the year. It is undeniable that it will have an impact on mobile revenues with no clear compensation from the fixed business,” he said.

Etisalat Group’s exposure to the NMC Health, UAE’s largest private hospital group, stood at AED 8.37m as of the end of March this year, representing outstanding receivables for telecom services extended to NMC and UAE Exchange Centre but it has no relation with Finablr company.

The troubled NMC Health borrowed over $6.6b without having to provide collateral from dozens of banks either headquartered or with bases in the region.

The Etisalat Group’s board of directors has approved an interim dividend of 15 fils per share for the second quarter, bringing interim dividend for first six months to 40 fils per share while the board of directors of du approved the distribution to shareholders of an interim dividend of AED589m, resulting in an interim dividend per share of AED0.13.

To sustain the increase in data traffic across the country and the company’s deployment plans, du invested AED 509m in the second quarter, equivalent to 19.1% of revenues.