Spectrum planning and allocation need to take a forward-looking approach

Goal should be to ensure accessibility for both new and existing players as the interest will continue to grow as new technologies emerge

Spectrum has become scarce and a rare commodity and given the changing demand and supply, countries need to implement a balanced strategy that requires a thorough understanding of the trends affecting the spectrum, insight into the priorities of users and stakeholders, and knowledge of the supply, industry experts said.

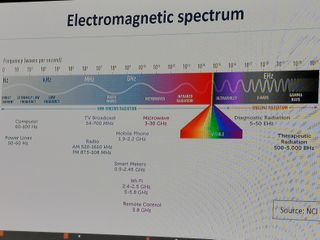

The electromagnetic spectrum is the range of frequencies from 3 kilohertz (kHz) to 300 gigahertz (GHz) that carries radio signals to enable connectivity to mobile phones, TV broadcasting, maritime communications, remote sensing, earth exploration, radio sciences, weather forecasting, global positioning systems, space exploration, intelligent transportation systems, and high-altitude platform stations.

David Panhans, Managing Director and Partner at Boston Consulting Group Middle East, said that spectrum planning and allocation must take a forward-looking approach due to the emergence of new actors, developing new technologies – as industry verticals such as low-orbit satellites, drones, autonomous vehicles, IoT, etc. start to mature.

He said the race for spectrum access and allocation will increase as it becomes a matter of socio-economical and national interest. To develop a future proof spectrum strategy, he said that it would require conducting a broad impact assessment across various dimensions, including technology, the economy, public and social services, and national interests, apart from the economic benefits of facilitating access to spectrum.

However, he said the goal should be to ensure the accessibility of spectrum for both new and existing users as the interest in radio frequency bands will continue to grow, putting pressure on existing users, potential users and regulators.

“We need to take a broader and holistic view of the ecosystem and not just focus on the telecom operators but also on the different players in the 5G market. 5G promises to be a network of networks and it includes telecom operators, satellite operators, private local 5G deployments (with dedicated spectrum sometimes) amongst other players,” Faisal Hamady, Principal at BCG Middle East, said.

He said that private/local 5G deployments in the Gulf Cooperation Council (GCC) countries are in the experimental stage and how each country is approaching it is quite different.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

For example, Germany, Finland, Japan have taken a quite different approach to it and focused a lot on dedicating spectrum to private 5G network deployments.

Private network means slicing the network and giving a dedicated spectrum only for a vertical such as manufacturing, logistics, academia, etc.

- Telecommunications regulator to unveil UAE's 5G strategy for next five years

- GSMA expects cross-border data sharing to take off in Mena from next year

- Intelligent connectivity to drive huge economic growth and create value across industries

- GSMA looks into interoperability of 5G equipment from networking vendors

GCC needs to experiment with private spectrum

Hamady said that Germany, Finland, Japan have dedicated spectrum for specific verticals while France has put legal requirements on mobile operators to either provide the service to certain verticals with certain SLAs or to be able to give back the spectrum to these verticals. In the UK, they get vertical access on a shared basis.

What needs to happen in the GCC region, he said is that GCC should experiment more by defining vertical spectrum and it is not a proven model yet?

“It allows sparking some innovation in logistics, manufacturing plants and ports to start experimenting more with 5G. They can accelerate the deployment of digital initiative without the need to wait for mobile operators to roll out the services.

“It also may also allow some SMEs to see the light in terms of new business models (such as deploying, operating, and maintaining private/local 5G networks). On the long run, it may put pressure on telecom operators to have certain quality requirements for these verticals that are crucial for the economy and it would also allow telecom operators to evolve their business models,” he said.

Even though GCC does not have large manufacturing plants, Panhans said that the region has huge organisations in oil and gas, energy, and logistics sectors.

“Every country has its own strong foothold. National champions can build their own private networks to connect to different offshore fields for example and have new innovative solutions in their field operations and so on,” he said.

However, he said that it [private networks] is a tradeoff and have seen in the past of relatively protected approach towards telecom operators and the situation today is still that the telcos are a significant part of the federal budget in the GCC.

“I don’t think telcos have cracked the sweet spot in 5G yet but if they do, with the right ecosystem of partners, they are thinking of what role they could be in the IoT space and what vertical solutions they can offer. Historically, operators have been slow in pushing innovation,” he said.

Refarm the unutilised spectrum

In the B2B market, Hamady said that telcos would look into serving them in terms of building networks for private companies, operating and maintaining them on a regular basis.

Moreover, he said that GCC is the right target for telcos in providing private networks for airports, seaports and logistics.

“The challenge for telcos is that will they be able to go to the market and really provide customised and tailored solutions for all of these deployments while each one has different requirements. Some would value reliability requirement while some would have latency requirements,” he said.

So, slicing the network at a very granule level for all of these players will also be challenging for the network operators, he said.

“It [private networks] is not completely geared up today but it is better for telecom operators to experiment and explore it today that can bring the benefit to the market,” he said.

At the same time, Panhans said that telcos also need to have guarantees that the heavy Capex intense network investment they make gives them predictability and are put in a secured place in the spectrum.

“There are certain spectrum areas that are not fully utilised such as satellite TV broadcasters, terrestrial TVs and that is why certain European countries are trying to refarm the unutilised spectrum from terrestrial TVs and satellite TVs,” he said.

“Countries should look at it holistically and see at what is still available and, at the same time, do not disrupt the requirements of 5G that the operators have in the mobile space.”

Furthermore, he said that there are other areas where telcos should prepare for new types of users that may appear in the future and not lock everything in as they will not find flexibility in the coming years if there are other requirements such as low-orbit satellites, autonomous vehicles and drones.

In the legacy usages, he said that people are not aware that they are occupying something extremely valuable and once they create awareness and education, they can use it [spectrum] for alternative usages from broadcasters.

Hamady said that there are ways but it needs to be identified and action needs to be taken on the plan.

That is why Panhans said that it leads to the role of a “spectrum manager” as compared to a “spectrum administrator” who can evaluate the value of the spectrum and have a holistic view.

“It needs to be elevated to a national topic as telecom regulators will not be able to talk to the Ministry of Defence to free up the spectrum and they have no chance of success. Spectrum managers need an innovative framework and tools to accommodate the current and future complexities of demand and allocate the uneven supply,” he said.

However, he said that if they make it a national agenda and at the right level to start a discussion with the right players in the market to understand the tradeoff as there too many stakeholders and too many national interests in that.

New models are emerging

Traditional ways of allocating spectrum have created multiple challenges that need to be addressed; Panhans said and added that one such challenge is how to repurpose bands, such as very high frequency (VHF) and ultrahigh-frequency (UHF) for new types of uses (digital broadcasting) while the other hurdle is how to free up congested bands to eliminate interference.

“New policies and streamlined procedures must fit the current demand and cater to future uses,” he said.

New models are emerging, he said, that have frameworks and tools to help spectrum managers harmonise and manage tradeoffs and make informed decisions regarding emerging uses.

The new models look nothing like the old one, which largely allocated spectrum on a first-come, first-served basis. They need to push some decision making to spectrum users, and leverage emerging technologies to create more autonomous environments that help countries and users alike maximise value creation and future potential,” he said.

With the emergence of newer technologies, Hamady said that there are three main elements to be able to have a healthy spectrum ecosystem.

“They need a mix of spectrum for commercial licences [satellite operators, telecom operators, fixed players, etc.], unlicensed spectrum and this needs to have different parts of the spectrum [specific unlicensed in the low-band, mid-band and high-band], and spectrum for civil and governmental use,” he said.