Huawei to regain its top ranking in 5G mobile base station market this year

China’s aggressive rollout of 5G networks and applications will spur growth for the company

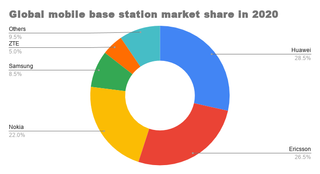

Huawei is expected to regain its number one status in 5G mobile base station market this year after losing ground to Ericsson last year due to the US ban.

According to research firm TrendForce, Huawei is expected to attain 28.5% market share compared to 27.5% last year as China has been aggressive in developing 5G networks, with more than 400 5G-related innovative applications in transportation, logistics, manufacturing, and healthcare in the first half of the year.

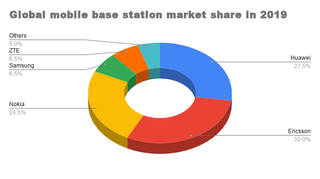

Chinese and European equipment manufacturers captured more than 85% market share in the global mobile base station industry in 2019, with Sweden-based Ericsson, China-based Huawei, and Finland-based Nokia as the three largest suppliers.

Ericsson, which had a 30% market share in 2019, is expected to dip to 26.5% this year.

Kelly Hsieh, Research Vice-President at TrendForce, said that the growth in mobile data consumption, low-latency applications (such as self-driving cars, remote surgeries, and smart manufacturing), and large-scale M2M (smart cities) requires an increase in 5G base stations for support.

“Constructing these base stations will likely bring various benefits, such as investment stability, value chain development, and interdisciplinary partnerships between the telecommunication industry and other industries,” she said.

However, she said that Huawei is expected to focus its base station construction this year primarily in domestic China.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Samsung gains traction

By the end of the first half, the three major Chinese mobile network operators, including China Mobile, China Unicom, and China Telecom, had built more than 250,000 5G base stations in China and this number is projected to exceed 600,000 in 2020 while Japanese and Korean equipment manufacturers aggressively expand in the overseas markets.

In addition, Hsieh said that emerging infrastructures such as 5G networks and all-optical networks will generate commercial opportunities for Huawei.

According to the GSM Association’s forecasts, by 2025, more than a quarter of cellular devices in China will operate on 5G networks, occupying one-third of all global 5G connections.

Samsung has seen a surge in its base station equipment due to the successful 5G commercialisation efforts in Korea.

The company has provided base stations for the three major mobile network operators in Korea, including SKT, KT, and LG Uplus, in addition to collaborating with US operators, such as AT&T, Sprint, and Verizon.