Etisalat Group’s 2019 profit increases despite tough market conditions

Abu Dhabi-listed telecom operator proposes dividend payout of 40 fils per share for the second half of last year

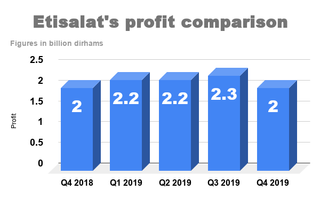

Etisalat Group’s 2019 net profit after royalty increased by 1% to AED 8.7b compared to AED 8.6b a year ago despite tough market conditions.

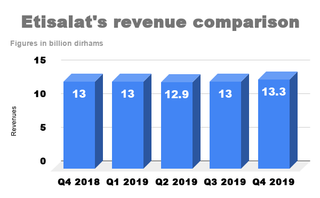

The Abu Dhabi-listed telecom operator’s group revenue fell by 0.38% to AED 52.2b this year compared to AED 52.4b a year ago due to currency fluctuations and decrease in mobile revenues from UAE operations.

The pre-paid mobile market is under pressure for the last few quarters due to weak consumer confidence and telecom operators have been focusing on post-paid mobile market to increase the average revenue per user and keep their revenues and profits from decreasing.

According to research firm International Data Corporation, telecom services are feeling the impact of weak consumer confidence and a slowdown in mobile data services.

Even in 2020, the spending in the telecom sector is expected to grow the slowest at 1.01%.

Sukhdev Singh, executive director at research and consulting services provider Kantar, told TechRadar Middle East, that most businesses in the UAE are facing headwinds for the last two to three years, impacting the overall economy in many ways, including the usage of telecom services.

However, he said that Etisalat has managed to broadly retain its bottom-line despite shrinking revenues. “As we get closer to the Expo 2020, which kicks off in the fourth quarter of 2020, economic activities are expected to pick up and help telcos ahead of other sectors,” he said.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Etisalat’s aggregate subscriber base reached 149 million, representing a 6% year-on-year increase.

The company has proposed a dividend payout of 40 fils per share for the second half of 2019, representing a total dividend payout of 80 fils for the full year and a dividend payout ratio of 80%.

- Etisalat to cover 30% of populated areas of UAE with 5G this year

- Etisalat aims to stay ahead of its Middle East peers in 5G race

- Etisalat to open two more data centers in UAE

Saleh Abdullah Al Abdooli, Group Chief Executive Officer, Etisalat Group, said that 5G is a game-changer with Etisalat taking the lead in the launch of the network which will amplify the use of futuristic services, target new opportunities and implement 5G use cases across verticals.

“This has also set the roadmap for services based on emerging technologies such as IoT, cloud, big data, AI, robotics, autonomous, AR/VR, becoming a trusted partner that supports transformation in a digitally disrupted and fully connected world,” he said.

Even though local telcos are taking a lead in offering 5G networks, Singh said that the 5G pickup is not likely to break the ceiling anytime soon, given the limited handsets in the affordable range.

“Furthermore, the excellent 4G network in the UAE leaves a little need to have anything faster except for its novelty factor. IoT and M2M adoption are likely to help the 5G adoption more than the consumer demand in the initial phase,” he said.

The operator’s fourth-quarter profit remained steady at AED 2b despite revenues increasing by 2.3% to AED 13.3b compared to AED 13b a year ago.