Amid Covid-19, startups in MENA attract $659m investments in first half

UAE receives lion’s share of total funding while Egypt maintains its first rank by number of deals

Startups in the Middle East and North Africa (MENA) have seen an investment of $659m in the first half of this year despite Covid-19 pandemic.

Philip Bahoshy, CEO and Founder of region’s largest startup data platform MAGNiTT, said last year that $1b of venture investment is expected to happen in MENA-based startups this year.

“95% of the total venture investments in the full year of 2019 have happened in the first half of this year itself and the total funding saw a 35% year-on-year increase, witnessing more investments in fewer startups,” he said.

However, he said that it is more likely that the full impact of the pandemic-19 will hit venture figures later in the year.

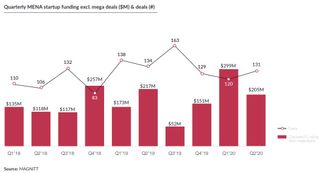

According to MAGNiTT, the total number of deals in the first half of this year is down 8% compared to the same period last year and is only 45% of last year’s total deals.

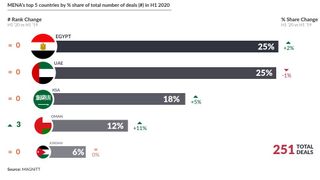

The UAE continued to receive the lion’s share of total funding in the first half of this year (59%) with multiple large-ticket deals such as EMPG ($150M), Kitopi ($60M) and SellAnyCar ($35M).

In contrast, the more nascent ecosystems of Egypt and Saudi Arabia also saw over a 100% increase in funding year over year.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Shift in investor appetite

Egypt maintained its first rank by the number of deals, accounting for 25% of all transactions in MENA in the first half while Saudi Arabia saw the largest percentage increase in total funding.

“The continued growth of these two ecosystems, despite the crisis, considerably contributed to a strong start to the year. The regional entrepreneurship space is seeing new opportunities and challenges as a result.

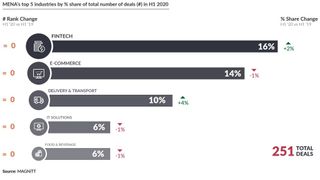

“Covid-19 has been a much-needed and rapid accelerant of digital transformation and tech-adoption in the region. This has been reflected in the funding trends, particularly for startups in industries that have been ‘positively’ impacted by the current pandemic climate - edtech, fintech, and healthtech,” he said.

Unsurprisingly, he said the outbreak has resulted in a shift in investor appetite as well.

“Concerning the industry, 27% of investors have indicated that they had shifted to focus on industries that are more ‘positively impacted’. Concerning the funding stage, investors have been increasingly looking at later-stage deals, either through new investments or as follow-on rounds in their existing portfolio companies. This has highlighted an approach towards larger investments on more established startups as opposed to smaller deals in ‘riskier’ earlier stage startups,” he said.

Despite 75% of investors expect that the region is heading towards an economic recession, Bahoshy said that startups remain more pessimistic with 24% expecting that the region is heading towards a depression.

MAGNiTT research also highlighted that 77% of surveyed startups have yet to benefit from government initiatives to support their operations.

Over the last 10 years, Bahoshy said that a lot of energy and investment has been put into building the ecosystem across the region.

“We have seen that there remains a clear appetite for venture capital as an asset class in the region. Policy decisions and initiatives are required now to support startups and their employees during this time and help them navigate this crisis.

“A healthy and flourishing entrepreneurial ecosystem takes years, if not decades, to build and develop. Supporting founders and encouraging investors now will benefit the ecosystem for many years to come,” he said.