ADIA becomes second sovereign wealth fund from UAE to invest in Jio Platforms

Abu Dhabi-based sovereign investor invests $752m in the platform while Reliance has now sold a combined 21.06% stake in seven fundraising deals to attract $13b

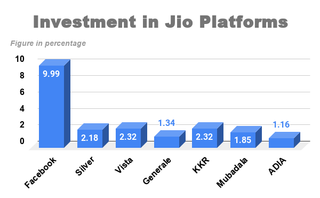

Abu Dhabi Investment Authority (ADIA), a sovereign wealth fund owned by the Emirate of Abu Dhabi, is buying a 1.16% stake in Reliance Industries’ Jio Platforms for $752m.

Last week, Mubadala, Abu Dhabi’s strategic investment arm, invested $1.2b to buy a 1.85% stake in the platform.

According to the Sovereign Wealth Fund Institute, ADIA is ranked third globally with $579.6b while Mubadala is ranked 13th with $232.14b assets.

Reliance has now sold 21.06% stake in the platform and has secured about $13b in less than seven weeks.

“The rapid growth of the (Jio) business, which has established itself as a market leader in just four years, has been built on a strong track record of strategic execution," Hamad Shahwan Aldhaheri, executive director in ADIA's private equities department, said in a statement.

Other investors in the platform include Facebook, Vista Equity Partners, General Atlantic, KKR, two tranches from Silver Lake and then Mubadala.

"I am delighted that ADIA, with its track record of more than four decades of successful long-term value investing across the world, is partnering with Jio Platforms in its mission to take India to digital leadership and generate inclusive growth opportunities. This investment is a strong endorsement of our strategy and India''s potential,” Mukesh Ambani, Chairman and Managing Director of Reliance Industries, said.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

The transaction is subject to regulatory and other customary approvals.